The insurance industry is undergoing a digital transformation, reshaping distribution channels and customer engagement. This article explores innovative strategies, cutting-edge technologies, and actionable insights to thrive in this evolving landscape. We’ll uncover how to stay competitive and seize opportunities in the digital future of insurance distribution.

Current Challenges in Insurance Distribution

The distribution of insurance is confronted by a number of challenges as the industry seeks to embrace digitalization. These challenges must be addressed strategically in order to keep pace with evolving consumer expectations, technological innovation, and market forces. Following are important challenges and tips on how to overcome them.

Evolving Consumer Expectations

Today, customers expect digital-first, personalized, and seamless experiences from their insurers. The traditional processes fail to match these standards, leading to gaps in customer satisfaction. The difficult part is combining sophisticated tools such as AI and data analytics in order to provide customized interactions and ensure accessibility and transparency in every touchpoint.

Technological Integration and Innovation

Shifting to today's digital distribution models involves high investments and organizational transformation. Several insurers encounter challenges in bringing together legacy systems and new platforms, resulting in inefficiencies and possible disruptions. Adopting cloud computing, APIs, and automation technologies successfully is crucial to drive scalability, lower costs, and improve efficiency.

Regulatory Compliance and Data Privacy

Compliance with changing regulation and maintaining data privacy contribute to additional complexity for insurers. Digitalization poses higher cyber risks and data breaches, which require enhanced cybersecurity protocols. Achieving innovation and compliance requires overall strategies to establish trust and offset operational risk.

Trends Shaping the Digital Future

The digital revolution of the insurance sector is still guided by new technologies and evolving consumer demands. These innovations open doors to new solutions, which help organizations remain competitive while operating in intricate regulatory environments. Some of the most important trends that are shaping the digital future of the insurance market are listed below.

1. AI and Machine Learning

AI and ML are transforming the insurance industry by empowering accurate risk evaluation, automated underwriting, and customized customer interactions. Insurers are using these technologies to process huge amounts of data, identify trends, and improve decision-making.

Chatbots developed with ML enhance customer services through faster and accurate responses, improving interaction. Predictive analytics also enables insurers to predict risks, eliminate fraud, and optimize price models, making it more efficient and customer-oriented services.

2. Internet of Things (IoT)

IoT technologies and telematics are revolutionizing customer engagement and risk management. Smart home devices, for example, gather real-time data that is utilized by insurers to determine risk more accurately. Vehicle telematics enables insurers to provide usage-based policies, rewarding safe driving habits with lower premiums. The technologies not only optimize claims handling but also promote customers to adopt safer behaviors, leading to a more proactive insurer-policyholder relationship.

3. Blockchain for Security

Blockchain technology is also answering security, trust, and transparency issues in the insurance sector. With its tamper-proof record-keeping ability, blockchain makes claim settlements easier, reduces fraud, and holds people accountable. Smart contracts make managing policies easier by automatically settling claims upon satisfaction of pre-stated conditions. This decentralized approach increases operational efficiency and gains customers' trust by ensuring secure and transparent transactions.

4. Cloud Computing and Scalability

Cloud computing is enabling insurers to scale operations seamlessly while improving data accessibility and security. By adopting cloud-based platforms, companies can store, analyze, and retrieve large amounts of data in real time. This infrastructure supports collaborative tools, innovation, and faster service delivery. Additionally, cloud computing ensures cost efficiency by reducing dependency on maintaining physical IT infrastructures, allowing businesses to reinvest savings into customer-centric enhancements.

5. Customer-Centric Digital Platforms

Digital platforms are reshaping the way insurers interact with customers by providing seamless, personalized experiences. Self-service portals and mobile apps empower policyholders to manage policies, file claims, and access support on demand. Personalization, driven by data insights, helps insurers deliver tailored recommendations and solutions. Focusing on customer-centric initiatives enhances satisfaction, loyalty, and retention, ensuring that insurers remain competitive in an increasingly digital world.

Strategies for Success in Digital Distribution

To thrive in the rapidly evolving landscape of digital insurance, companies must adopt innovative strategies that prioritize efficiency, personalization, and customer engagement. By focusing on the right tools and approaches, insurers can streamline their operations, optimize their distribution channels, and elevate the overall customer experience. Below are key strategies to achieve success in digital distribution.

Leverage Advanced Data Analytics

Data analytics serves as the backbone of digital distribution, enabling insurers to gain actionable insights into customer behavior and preferences. By analyzing large volumes of data, companies can identify trends, anticipate customer needs, and create highly personalized offeringsPredictive analytics is key for risk assessment and pricing, helping insurers improve accuracy and make better decisions. Robust analytics platforms keep insurers competitive.

Adopt Omnichannel Distribution

Omnichannel distribution ensures a seamless and consistent experience, regardless of how customers interact with an insurer. By integrating channels such as websites, mobile apps, social media platforms, and call centers, companies can provide a cohesive and user-friendly experience. This approach increases convenience for customers and allows insurers to engage with them in their preferred manner.

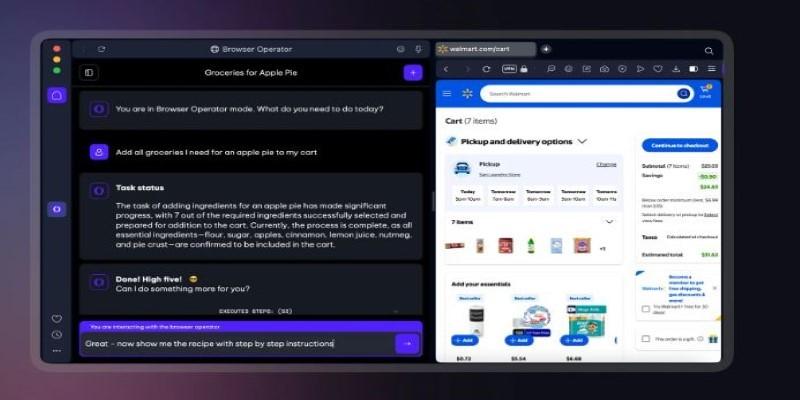

Invest in Digital Tools and Automation

Automation and digital tools are critical for optimizing workflows and enhancing efficiency in insurance operations. Technologies like AI-powered chatbots, automated underwriting, and claims processing reduce manual efforts and accelerate service delivery. Providing self-service capabilities through interactive platforms empowers customers to quickly resolve issues and access support. Investing in the right technologies ensures scalability and agility, enabling insurers to adapt to changing market conditions effectively.

Streamlining Data Management

Efficient data management is a cornerstone of enhancing insurance operations. Leveraging centralized data platforms and adopting advanced analytics tools can help insurers organize, analyze, and utilize vast amounts of information effectively. This strategy not only improves accuracy in decision-making but also provides valuable insights into customer behavior and market trends, giving companies a competitive advantage.

Fostering Customer-Centric Solutions

Implementing customer-centric strategies ensures that the services offered align with evolving customer expectations. Personalization through data-driven insights and AI solutions allows insurers to tailor products and communication to individual needs. By prioritizing transparency and proactive engagement, companies can build stronger relationships and foster long-term customer loyalty.

Conclusion

The digital transformation of insurance distribution presents immense opportunities for innovation, efficiency, and enhanced customer engagement. By embracing emerging technologies like AI, IoT, and cloud computing, and adopting customer-centric, data-driven strategies, insurers can overcome industry challenges and stay ahead of evolving expectations. The future belongs to agile, tech-savvy companies that prioritize seamless experiences and build lasting trust in a competitive, digital-first insurance landscape. Now is the time to lead the change.