AI is changing the finance departments by increasing the speed and intelligence of tasks performed. However, how can you get actual return of investment (ROI)? This guide addresses the problem of how to adopt AI in the practical sense to work on your finance department so that your efforts are applied to the available tangible business.

Understanding ROI from AI in Finance

ROI is an abbreviation of the return on investment. It is an observation of the way you benefit relative to amount you spend. When you are employing AI in your finance operation you would like to consider whether the utility exceeds the expenditure. Time savings, fewer errors, improved decisions and reduction in cost can be some of the benefits that can be enjoyed.

ROI is an abbreviation of the return on investment. It is an observation of the way you benefit relative to amount you spend. When you are employing AI in your finance operation you would like to consider whether the utility exceeds the expenditure. Time savings, fewer errors, improved decisions and reduction in cost can be some of the benefits that can be enjoyed.

Why ROI Matters in Finance

Finance experts will never get out of their minds concerning value. All the tools and processes should be able to deliver measurable outcomes. AI technologies may appear very promising, yet unless they are properly utilized they may not bring any actual returns. This is the reason why we need to understand the way to make wise use of them.

Step 1: Identify the Right Use Cases

Not all finance tasks need AI. Start by picking the areas where AI can save the most time or reduce errors. Here are a few common use cases:

Accounts Payable and Receivable

AI simplifies invoice processing by extracting data, matching it to purchase orders, and posting it with minimal human input. It tracks payment due dates, sends reminders, and flags unusual transactions for review. This reduces delays, errors, and costly issues like late fees or duplicate payments.

Budgeting and Forecasting

AI analyzes historical financial data to create accurate forecasts by detecting trends and patterns that humans might miss. This helps companies plan better, make smarter financial decisions, allocate resources effectively, and anticipate challenges.

Fraud Detection

AI monitors financial transactions in real time, using machine learning to spot suspicious patterns or behaviors that might indicate fraud. By learning from new data, AI tools adapt to emerging threats and reduce false positives, protecting the business and preventing fraud before it escalates.

Step 2: Choose Tools That Fit Your Business

The market is full of AI tools for finance. Choosing the right one is key. Look for tools that are easy to integrate with your existing systems. They should also be user-friendly so your team doesn’t need weeks of training.

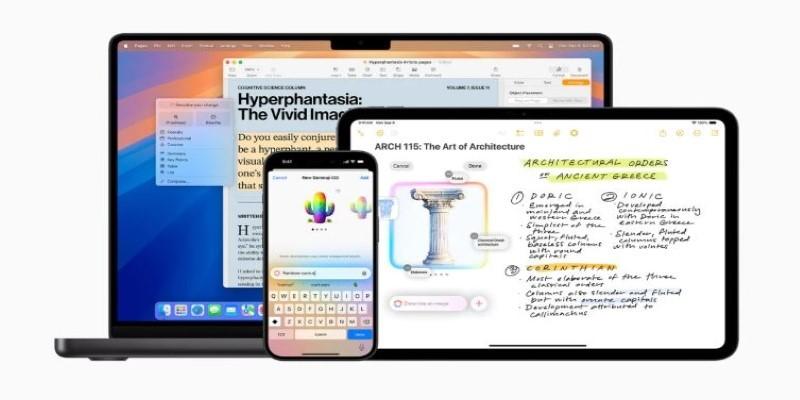

Cloud-Based Solutions

Finance teams use cloud tools for their flexibility and cost-effectiveness, helping businesses work smarter without major upfront costs. These tools include AI-powered expense trackers for monitoring spending, reporting platforms with real-time insights, and automation bots for tasks like invoice processing. Running in the cloud, they eliminate the need for expensive hardware and allow access from anywhere with an internet connection.

Scalable Platforms

As your business grows, it’s important to choose tools that can scale with your needs. Scalable platforms handle increased data, users, and operations without losing performance. Look for tools that offer scalability, regular updates to meet industry changes, and strong customer support to keep systems efficient as your business evolves.

Step 3: Train Your Team to Use AI

Having the best tool means nothing if your team doesn’t use it properly. You need to train your finance team on how AI works, what it can do, and how to apply it to their daily work.

Encourage Upskilling

Provide basic AI and data literacy training to empower your team. Help them understand how AI works, interpret its outputs, and trust the system. Training can include workshops, online courses, or guest speakers specializing in AI. When your team has the right knowledge, it reduces resistance to new tools and sparks innovative ways to use them.

Appoint AI Champions

Choose enthusiastic team members to be AI champions. They’ll advocate for new tools, assist with troubleshooting, provide peer support, and guide others through the learning curve. AI champions also bridge the gap between leadership and the team, ensuring feedback is heard and tools are used effectively. Dedicated champions make adopting AI easier and help integrate it into daily workflows.

Step 4: Set Clear ROI Goals

Before you launch any AI tool, set clear and measurable goals. Think about what success looks like. It could be:

- Reducing monthly processing time by 40%

- Catching 90% of payment errors

- Automating 70% of repetitive tasks

These goals will help you check if your AI investment is really paying off.

Monitor and Measure Results

Track progress regularly. Use dashboards and KPIs to measure time saved, money saved, and improvements in accuracy. Adjust your approach based on the results.

Step 5: Use AI for Smarter Decision-Making

AI isn’t just for automation. It can help finance teams analyze complex datasets, identify trends, and make better, more informed decisions. By leveraging AI, finance professionals can uncover insights more quickly, optimize processes, and drive smarter strategies for business growth.

Predictive Analytics

AI tools analyze trends and historical data to predict future outcomes, such as cash flow, revenue changes, or clients likely to delay payments. This foresight helps teams address potential issues early and make informed decisions to improve financial stability.

Real-Time Insights

Unlike traditional reports, AI-powered dashboards deliver real-time updates. They track key metrics, detect anomalies, and highlight trends as they happen. This instant access to insights helps businesses respond quickly to market changes and improve decision-making..

Step 6: Start Small, Then Scale

You don’t need to transform everything at once. Start with one or two AI projects. Learn what works and what doesn’t. Once you get results, expand the use of AI across your finance operations.

Run Pilot Projects

Pilot projects allow you to test AI tools in a small part of your finance function. Choose a high-impact area and monitor the outcome. If it works well, apply the same idea elsewhere.

Step 7: Ensure Data Quality and Security

AI systems rely heavily on high-quality data to function effectively. If the data fed into the system is incomplete, inaccurate, or biased, the AI's results will reflect these flaws, leading to poor performance and unreliable outputs.

AI systems rely heavily on high-quality data to function effectively. If the data fed into the system is incomplete, inaccurate, or biased, the AI's results will reflect these flaws, leading to poor performance and unreliable outputs.

Clean and Organised Data

Keep your financial data clean, updated, and well-structured. Disorganised data can lead to errors and poor decisions. Reliable, properly formatted data allows AI tools to deliver accurate insights, predictions, and actionable strategies. Regular audits and updates help maintain this standard.

Secure Systems

Finance data is sensitive and needs strong protection. Choose AI tools with robust security features like role-based access, encryption, regular updates, and backup systems. These safeguards protect your data, ensure compliance, and give you peace of mind while using AI for financial management.

Step 8: Collaborate Across Departments

AI works best when departments collaborate. Finance teams should work with IT, HR, and operations to find areas where AI can improve workflows and automate tasks. Open communication helps identify repetitive or time-consuming processes AI can handle.

For example, linking financial AI tools with payroll systems offers real-time insights into employee costs, while integrating with procurement systems improves budget tracking and vendor management. These connections provide a clearer view of operations, enabling smarter decisions and greater efficiency.

Final Thoughts

Getting ROI from AI in your finance function is possible when you start with the right approach. Choose tasks that benefit from automation, pick user-friendly tools, train your team, and track your progress. AI is not a magic solution, but if you use it wisely, it can save time, reduce errors, and help your finance team add more value to the business.